For conservative investors:

Our goal is to help accelerate and protect your family’s

wealth. While passive investing with an index

mutual fund can allow you tread water, to swim ahead you need

to work with superior individual stocks. Premium stocks are

hard to find, and human bias and broker compensation schemes

can pervert most recommendations. Key benefit of artificial intelligence.

To do better than human attempts, we use advanced artificial intelligence methods that objectively find the superior stocks every day. Without human bias, the track record is superb. Please take a look.

Superior performance from bedrock stocks.

While we provide portfolio recommendations for over 40 market segments to large professional investors, we suggest individual conservative investors are best served by the large stocks that are the bedrock of the US economy. Thus, we recommend 10 stocks every day out of the largest 100 US stocks for conservative investors. Of course, you are free to act on, filter, or ignore these artificial intelligence originated recommendations.

Extraordinary capability.

Artificial intelligence can evaluate hundreds of inter-related market factors affecting every corner of the market, far beyond any human’s capabilities. (The ZZAlpha® artificial intelligence system makes 2 trillion calculations to reach its over-night recommendations.)

Published track record.

Unlike almost every other stock recommendation source, the artificial intelligence system tracks EVERY recommendation every day – it must do that in order to learn from the market. But more importantly, we then annually PUBLISH the outcomes of the stock recommendations for everyone to see and compare.

The greatest risk is falling behind.

If your investments are not exceeding the comparable benchmark, they are not protecting you: your family is falling behind. (Falling behind simply means you will be hurt more by the inevitable market downturns, recovery will be harder and it will take longer to accomplish your family wealth goals.)

Of course, the market goes up and down, and every investment portfolio rises and falls. But, over the longer run (5 years), superior investments should ALWAYS do better than their benchmarks.

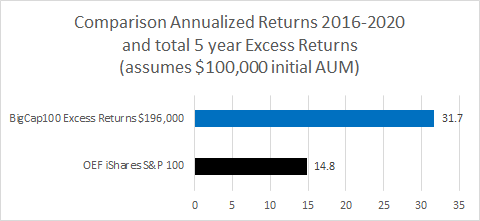

Stocks in 100 Largest Caps

(10 daily morning recommendations from the

100 largest cap stocks)The top five of our ten recommendations (the artificial intelligence technology scores and ranks each recommendation) had returns substantially exceeding the benchmark OEF ETF which tracks the Standard and Poors 100 index with over 31% annualized returns over the past 5 years (vs 15% for the benchmark). Because only largest cap stocks are considered, this set of recommendations provides extraordinary liquidity for subscribers with large AUM. Performance and Graphs

What we do

We provide you with 10 recommendations every morning before

the stock market opens.** We accompany the recommendations

with capitalization, recent liquidity, industry, and other

useful information. See the Sample.Our secret sauce

Constantly updating recommendations with daily fresh

information supports repetition of small gains that compound

rapidly over time. Our artificial intelligence uses only

objective, public facts of fundamentals, volume and price

unbiased by opinions. Proven artificial intelligence

algorithms and big data from the entire US market drive our

recommendations. We compute in a high-performance,

high-security cloud.There is no guarantee that returns will be similar in future market conditions. However we are not changing our consistent methods that gave these past recommendations. FAQs

We are independent.

We are not affiliated with any brokerage, ETF, financial

advisor or issuer. We do not accept compensation from

anyone to make a recommendation.We focus on tradeable stocks.

In all of the ZZAlpha® portfolios, we recommend

stocks listed on the NYSE, NASDAQ and Amex exchanges with

prices over $3 and with more than 80,000 shares traded

daily. ** To establish the ZZAlpha® track record, all recommendations have been certified and encrypted daily (prior to market open) since Nov 2011 by Digistamp Inc. to provide secure auditability. (Certification of our new algorithm recommendations began 2017.)

What we don't do

We don't handle your money.

You (or your trusted advisor) handle your money and buy and

sell as you choose. Not us. Our business is

making solid, methodical recommendations for plain old stock

trades. We don't compel you to trade. You are free to

use any recommendation or not. Some investors use only the

top one or two on a given day, or filter the recommendations

using the morning's news.We don't provide entertaining stories about stocks.

We focus on methodically recommending stocks that should

rise in price in the near future, not opinions or

entertainment. We don't recommend penny stocks or options.

We also don't recommend IPOs, pink sheet,

micro-capitalizations, foreign issues, derivatives, or

exotic risky securities.Persons seeking day-trading, high risk, hot-tips or illusory "opportunities" should consider whether the conservative, consistent trading process we support would be more profitable, safer and easier in the long run.

We don't provide personalized investment advice.

We offer to subscribers a daily newsletter focused on the largest stocks.Subscription information

or contact info@ZZAlpha.com for further information on subscriptions.Daily recommendations for conservative

investors.

Conservative Stock

Picks .com is a website and imprint owned by